Five Ways PKI Protects and Secures Financial Services Data

Data has become the lifeblood of the financial services industry. From managing transaction details and providing real-time account and trading information to automating risk management processes, forecasting, and fraud detection, data is integral and the most important resource to protect.

A recent study by Deloitte found that financial firms spent an average of 10% of their IT budget on cybersecurity and that CISOs rank keeping up with rapid IT changes and rising complexities in tech systems as top challenges, regardless of company size or maturity level.

Despite this, most financial firms are not sufficiently protected, lacking secure data encryption both at rest and in motion. Many fail to take full advantage of digital identity across all enterprise use cases. Financial institutions leveraging emerging business models dependent on the Internet of Things (IoT) are not recognizing the significant security risk represented by connected devices. Given the insurance, banking, and brokerage sectors’ growing reliance on data and the increasing digitization of financial services, now more than ever financial institutions must continually fortify their security capabilities and eliminate potential vulnerabilities to stay ahead of threats.

Threats Come from Many Directions

Any device, system, or organization that holds or transmits sensitive financial or customer information is at risk. Threats, which can originate from both internal and external sources, now run the gamut from malware and credit/debit card theft to phishing attempts, Business Email Compromise (BEC), ransomware-based extortion, and large-scale data breaches.

The consequences are far-reaching, as the Equifax data breach in 2017 made clear. The breach compromised the personally identifiable information of nearly 150 million consumers, exposing them to identity theft and other potentially serious consequences. According to the U.S. Government Accountability Office, Equifax had installed a tool to inspect network traffic for evidence of malicious activity, but an expired certificate prevented that tool from working correctly. As a result, cyber criminals were able to launch attacks and gather sensitive consumer information without being detected for 76 days. News of the breach led to federal investigations and a nationwide consumer class-action lawsuit, which the company is now reportedly paying $700 million to resolve.

One-Stop Digital Privacy, Identity, and Security

So, how can the financial services sector ensure security, privacy, and integrity of data? The answer: Public-Key Encryption (PKI), the gold standard in digital privacy, identity, and security. PKI offers an excellent security foundation for every device, server, user, and application in the enterprise, whether on-premise or on the cloud. Encrypting data at rest and in transit guards it against theft or tampering, and guarantees that digital identity provides secure authentication of users and applications to protect against fraud.

While nearly every financial services firm has incorporated PKI into its web and device security in some way, not all are fully or appropriately leveraging the power of PKI. Too often, organizations are overwhelmed when it comes to managing security certificates and secret keys throughout the enterprise, as it is complex and difficult to issue, manage, and revoke/renew/replace certificates and keys numbering in the thousands or even tens of thousands. Simply think of the magnitude of the Secure Shell (SSH) keys floating around in your enterprise that you may not even be aware of.

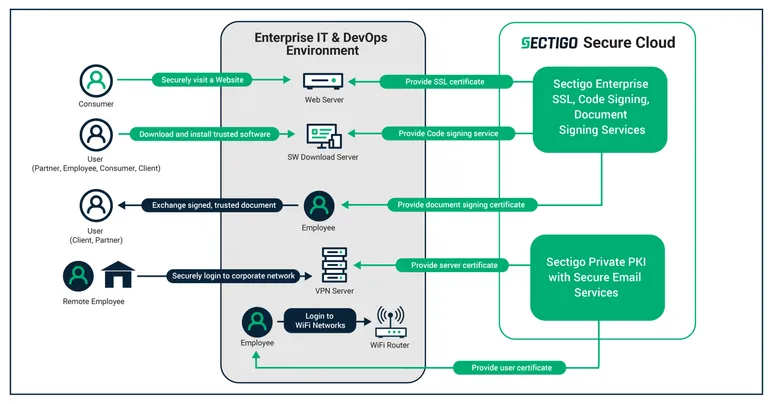

Many financial institutions are failing to see the broad range of digital assets and use cases that can be protected by PKI. Outside of using Secure Sockets Layer (SSL) PKI certificates to protect public-facing websites, enterprise PKI solutions can address the large-scale requirements for financial institutions with enterprise SSL, private PKI, zero-touch S/MIME email encryption, code signing, and document signing.

There are at least five ways PKI protects and secures financial services data:

- Enterprise SSL, which enables administrators to easily manage certificates through a single-pane-of-glass interface, is the ideal solution to secure online banking and transaction sites, customer information site, market analysis and forecasting sites, tax filing, insurance, securities trading, and data gathering sites.

- Private PKI, which allows financial institutions to secure devices and automates the management of internal devices and applications regardless of which internal protocols an enterprise has in place, is useful for supplementing Microsoft Active Directory Certificate Services, mobile devices, IoT, DevOps, cloud/multi-cloud, web servers, SSH Key management, Private S/MIME for secure email, intranet services, WiFi access, VPN access, POS systems, networking devices, and Windows Hello for Business.

- Using Zero-touch S/MIME for email enables both the sender and recipient to use their existing S/MIME-capable email applications on multiple devices – mobile or desktop; a welcome improvement to other approaches that disrupt the user experience by requiring users to use multiple certificate credentials. Zero-touch S/MIME is suited for email signing, email encryption, mobile email encryption, mobile WiFi access, and mobile website authentication.

- Code signing supports all file types, from drivers and firmware to scripts and applications. With enterprise-scale issuance, management, and renewal/revocation/replacement features, development teams have greater cryptographic flexibility and improved time to market for new financial services and products. Code signing allows your software to be trusted by users and helps with a wider adoption of it. It is optimal for application development, DevOps, mobile devices, and IoT.

- Document signing allows financial institutions to maintain compliance with the strictest electronic signature/digital signature regulations, such as U.S. FDA CFR 21 Part 11 requirements. Digital signatures leverage PKI certificates to offer the highest levels of security for regulated and sensitive document use cases like account openings, loan applications, investment/private banking, and insurance documents and agreements. If the document signing certificate is issued from a Certificate Authority (CA) that is in the Adobe Approved Trust List (AATL), the signed document can be universally exchanged with trust.

Given the consequences of failing to protect data, banks, insurers, and other financial institutions should leverage the powerful capabilities of PKI to protect against increasingly sophisticated threats and avoid costly attacks. With enterprise PKI solutions, the financial sector can future-proof security, protecting customer information, gaining a greater peace of mind, and maximizing the value of data.

To learn more about Sectigo’s PKI products for financial institutions, click here.